THE PARRA CORRESPONDENCE ADDRESSED TO Ndlambe LM REMAINS UNANSWERED AND THEREFORE WE ADDRESSED THE FOLLOWING LETTER BELOW:

*Please note that we post the correspondence addressed to Ndlambe LM on our social media and website for the sake of transparency and accountability.

Ndlambe Ratepayers Forum

26 Croydon Circle

Port Alfred

27/1/2022

Ndlambe Chief Financial Officer

Ndlambe Municipal Manager

Ndlambe LM Rates Tariffs and Property Valuation Roll and Legal Costs

Dear Sirs,

At a NRF meeting held on the 2nd of December a number of issues were discussed. I refer you to the letter written on the 8th December 2021 which went unanswered.

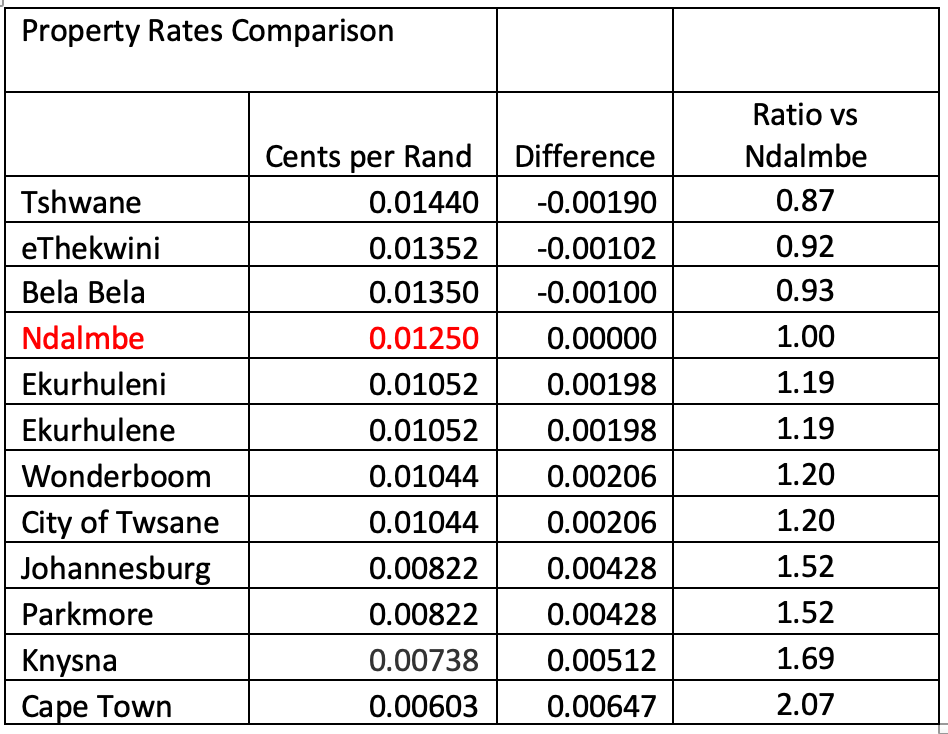

- Ndlambe currently have one of the highest tariff rates in South Africa (.0125 cents in the Rand). Comparisons are tabled below: (updated from Money Web 27/1/2022)

- This high rate is devastating and unaffordable for the numerous pensioners living in the Ndlambe LM.

- This high rate is discouraging businesses to open or move to Ndlambe.

- The high rate also discourages potential residents investing in the high end of the property market and moving to Ndlambe LM.

The NRF are asking Ndlambe LM to freeze the current rate of .0125 cents in the Rand for at least three years and then only to increase the rate based on the official inflation rate. The shortfall in income to Ndlambe LM can easily be remedied by cutting the overinflated budget items like overtime and casuals. Further income can be generated by the increased efficiency of collecting money from the water and electricity supplied to residents that the Municipality currently under collects according to the latest AG Report – Wasteful expenditure 11 Million Rand – Water Losses 27.1 Million Rand – Electricity Losses 6.3 Million Rand. The total of these 3 items result in a loss of revenue amounting to 44.4 million Rand. This inefficient collection and wasteful expenditure cannot continue. The AG has highlighted other instances of wasteful expenditure in their report.

- Valuation and Property Values

- New houses that have been being built since the last Valuation Roll was compiled do not appear on all the supplementary rolls with their new valuations resulting in rates on the new building value not being collected. What procedure is in place to audit and add the value of these new residences built since the last Valuation Roll was compiled?

- At our PARRA meeting the matter was raised that certain property owners are notreceiving any Municipal Utility Bills and thus are not paying for the services they are receiving. What procedures are in place to identify these property owners who are not receiving Utility Bills?

- Residents are building additions to their houses without the proper authorisation and plans being approved by the Ndlambe Planning Department resulting in an increase in their property value that has not been updated on the Valuation Roll.

- Residents are adding on decks and balconies over the building line that are not reflected in the approved building plans.

- Courts Costs borne by the Ndlambe LM Residents and Ratepayers

- Ndlambe Municipality continuously find themselves in court and these costs are escalating on an annual basis. The ratepayers obviously fund the Ndlambe LM legal costs.

- Is there any method where Ndalmbe can explain to the Ndlambe serial litigants that they themselves are paying Ndlambe LM courts costs and appealing to them to rather settle these matters around a table to reduce the high costs of litigation?

D van Wyk

NRF Chair