- The Operating Budget R 533 015 958 for 2022/23 with Capital Expenditure of R 149 502 571. The Revenue is R 648 026 685 and thus the shortfall is R 34 491 844.00.

- Auditor-General’s Report: What is going to be done about the R 17.4 Million water loss and the R 6.5 Million electricity loss? The water losses within the Ndlambe LM are cause for concern. All water meters should be correctly read monthly. Covered meters must be exposed and faulty meters replaced. Failing to ensure that this is done results in incorrect billing and loss in revenue.

Residents receiving FREE BASIC SERVICES who exceed the 6 kl allocation must be appropriately billed for the excess and/or water flow to be restricted to that erf/property.

Water should be correctly metered from Bulk meters down to residential meters to ensure that the municipality can pinpoint water usage and losses.

- Ndlambe LM indigents: When will the Ndlambe LM have a complete audited list, this could result in far more revenue in equitable share payments.

- The Debtor’s book should be sold off and no Ndlambe resident’s should have their municipal accounts written off except in exceptional circumstances. Again this would be a large revenue source to Ndlambe LM.

- Numerous residents are not receiving or paying their monthly Ndlambe LM accounts. An audit of account vs Erf Number needs to be properly done and the results reported back to the NRF. Newly bought property owners in some cases have not received Municipal accounts for six months.

- What steps have been taken by Ndlambe LM about the municipal employees and their close family and friends not declaring their interests in Municipal tenders and contracts?

- Standby allowances budget is R 1 493 321.00 and it appears just to be a method of increasing employee’s salaries. Do municipal employees employed by: Beaches and Jetties, Reserve Management, Community Parks, Fleet management, Licensing and Regulation and Pollution control justify standby allowances? They all need to be cut out of the standby budget. This amounts to a saving of R 802 996.00.

- Transport: Moral Regeneration, R16 000, CDW, R10 000. Participants receive remuneration for the work they do and should not require transportation from the Municipality Contractors transport: If they are contractors, they should have their own transportation. If not, how will they perform contractual work? Casual Day is not meant for the general public and should be restricted to municipal staff and no transport is required. Ward War rooms have been a failure and are non–functional. No transport is required. Election Transport: Do officials have information about an election that is classified?

- The budget for food, catering and beverages of R 1 111 135.00 must be cut drastically. Ratepayers do not pay rates so that Municipal employees can feed themselves. It is possible to cut this by R 861 616.00. Travel and subsistence should be cut to R 300 000.00 from R 498 102.00. Some events are over catered for – where tea/coffee and biscuits would suffice.

Casual day, Youth Day, Youth Council, Indigent catering, Library, Disability Forum, SMME, Prevention week, 16 days of activism, Local Aids, World Aids Day, Special event? Housing, Stakeholders engagement, ELECTION catering (no elections in 2023), Festivals, IDP review process, World TB day, Moral Regeneration, Petitions, Women’s month, Women’s Forum, World book day, Elderly month, CDW catering (They receive remuneration for the work they do).

Furthermore, we note PUBLIC ENTERTAINMENT in various forms amounting to R 225 000 and FOOD and BEVERAGE under WORKSHOP amounting to more than R 164 885.00

There are other numerous catering items not listed by us but that appear in the draft budget. Serious interrogation is required by departments to ensure that catering/food and beverages are curtailed. There is no FREE LUNCH and there should be an expectation of a return on this expense.

- The allowances budget amounts to R 11 505 109.00 and is being used to increase employees’ salaries. Who exactly are eligible for vehicle allowances? Town Planning vehicle allowances amount to R 620 157.00. Chief Executive: Local Economic Development vehicle allowance amounts to R 353 208.00.

- Overtime: The budget for overtime amounts to R 6 611 738.00 and again what control is there over paying these large sums of money when employees could do most of this work during normal weekly working hours? Only exceptions are electricity, sewage and water problems. The rest can be taken out of the budgets and that saving amounts to R 3 232 846.00. Only Directors should approve overtime. We accept that overtime is necessary in crisis situations and appreciate the work done by officials, but we have noted abuse of this facility.

- Local Economic Development (LED): Money spent on LED over the years and the quantifiable return on the money spent is questioned and must be critically examined. Money cannot be spent yearly on LED without meaningful jobs being created. Proposed budgetary amount R1 198 274 should be cut to R 600 000.00 Budgetary allocation for LED should be coupled to performance in creating more jobs.

- The budget for casuals is R 4 743 532.00 and is totally unnecessary and can cut by R 2 245 00.00. Kleinemonde commented that over the festive season the size of the teams that arrive are increased but the productivity is minimal. Casual workers should not be doing the job of permanent works. They should be an additional to the normal team.

- The Speaker and the Mayor both receive fully maintained and fuelled cars yet they still get paid car allowances amounting to R 272 880.11?

- The Maintenance Budget is R 36 697 924.00. All sums are rounded to the closest R 20 000 to R 50 000 indicating that there is little thought and detail in arriving at the budgeted amount of R 36 697 924.00. There is nothing in the budget for preventative maintenance. It appears we wait for a pump or motor to break down and then fix it. The NRF have never seen a comprehensive policy or schedule regarding preventative maintenance which is standard among most industries. This practice should be standard for all Ndlambe’s pumps.

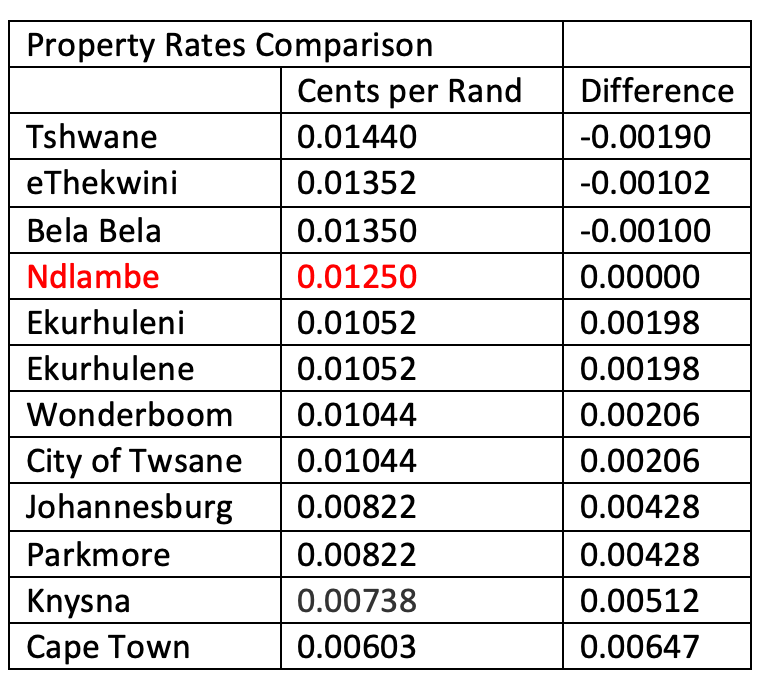

- An appeal was made by the NRF to the CFO to freeze the Property Rates of 0.0125 cents in the Rand in order to bring Ndlambe in line with other similar Municipalities whose rates are much lower. This was not granted. The new proposed tariff is 0.0132 cents in the Rand a 6% increase.There are other numerous revenues resources open to the Ndlambe LM like fines for breaking bylaws, increasing the equitable share by introducing an accurate auditing system, indigents paying for the electricity and water over their “free allowance” which is now paid for by the ratepayers.

Sale of property not generating income, leasing agreements brought into line with market values, not writing off such high levels of debt and stop the current abuse of the rebate system and to only grant rebates to genuinely deserving organisations or individuals. The rebate tariff lists also needs some revision as they are out of date.This ever increasing of the property rates results in retired people who live on fixed incomes not being able to afford the increases. It also has the effect of discouraging people investing in the high end of the property market due to Ndlambe’s high rates. Ndlambe depends largely on tourism and we do not want to discourage any investment due to the high property rates.Ndlambe currently have one of the highest tariff rates in South Africa (0.0125 cents in the Rand to be increased to 0.0132) in the 2022/3 budget). Comparisons are tabled below: (updated from Money Web 27/2/2022)

The NRF again appeal to the Municipality to look at other revenue streams rather than just increasing the rates year after year because it is the easiest way to balance the budget.

- There does not appear to any budgeting items for the Department of Infrastructure?

- In Ndlambe all three of our main rivers Kariega, Kowie and the Bushman’s have continuous flows of sewage into them. There are no specified items in the budget to firstly upgrade the sewage plants (with the increased population) and maintain problematic sewage pumps stations. Ndlambe’s main income is from tourism and the increase in sewage pollution on our previously pristine rivers will drive tourists to other destinations with the resultant drop in real estate sales and business incomes. The NRF would like to see a dedicated plan to stop the sewage flowing into our rivers.

- Finally one of the greatest complaints received by Ratepayers organisation is the item on their Municipal account for a water availability charge. This is budgeted to give an income of R 29 714 022.00 in 2022 2023. If residents do not have water in their taps why must they pay a water availability charge? Ndlambe LM needs to address this as it is the single biggest complaint the Ratepayers organisations receives and really harms the credibility of Ndlambe LM.

- Specific BRAGG Inputs are listed below:

Example of methods to increase revenue:

-

-

- Savings on budget

- Alternative methods of service delivery

- Access to Government funding e.g. joint lobbying

- Access to special funding i.e. small town development grants

- Grow municipal income by effectively managing items such as boat licencing

- Grow job opportunities by actively attracting suitable industry to our area with joint action between the Private Sector and Ndlambe

-

Methods to limit wasteful expenditure:

Ndlambe must move towards a Total Cost to Company (TCC) salary budget to be able to control the ballooning of the wage bill. Remove budget items which should not be there from previous budget templates.

Areas of main concern for Boesmansriviremond/Rivers Bend:

The sewerage plant in Marcelle on the banks of the Bushman’s river is not working but additional 500 houses are planned to be constructed. The infrastructure development is limited to a pump station and sewerage receiving bay from sewage trucks which means all the sewerage will be flowing untreated into the Boesmans river estuary.

No budget to address the Boesmans river estuary which is busy silting up and is in dire need for an Estuary Management Plan and actions to keep the estuary open.

By law enforcement – it is unacceptable to have one bylaw officer for the entire area. SAPS does not have the manpower to do the work of bylaw officers.

Governance is a concern as discussed and pointed out in the AG report. The issues in the AG report need urgent attention as we see the same issues year after year. (Copy & Paste)

Dawie van Wyk

NRF Chair

(Compiled from various Ndlambe Ratepayers’ organisations)

29th April 2022